fit on paycheck stub

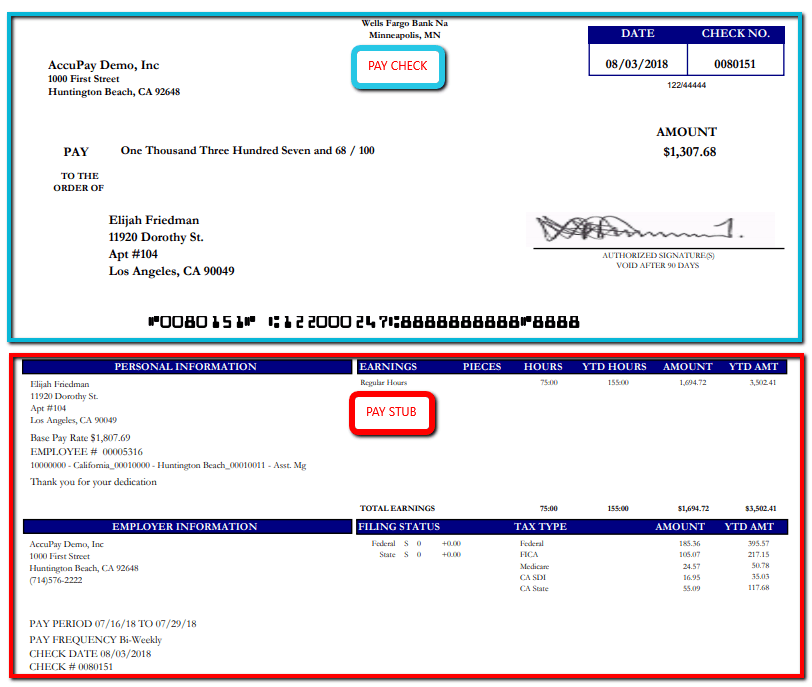

In the United States federal income tax is determined by the Internal Revenue Service. Pay stubs are written pay statements that show each employees paycheck details for each pay period.

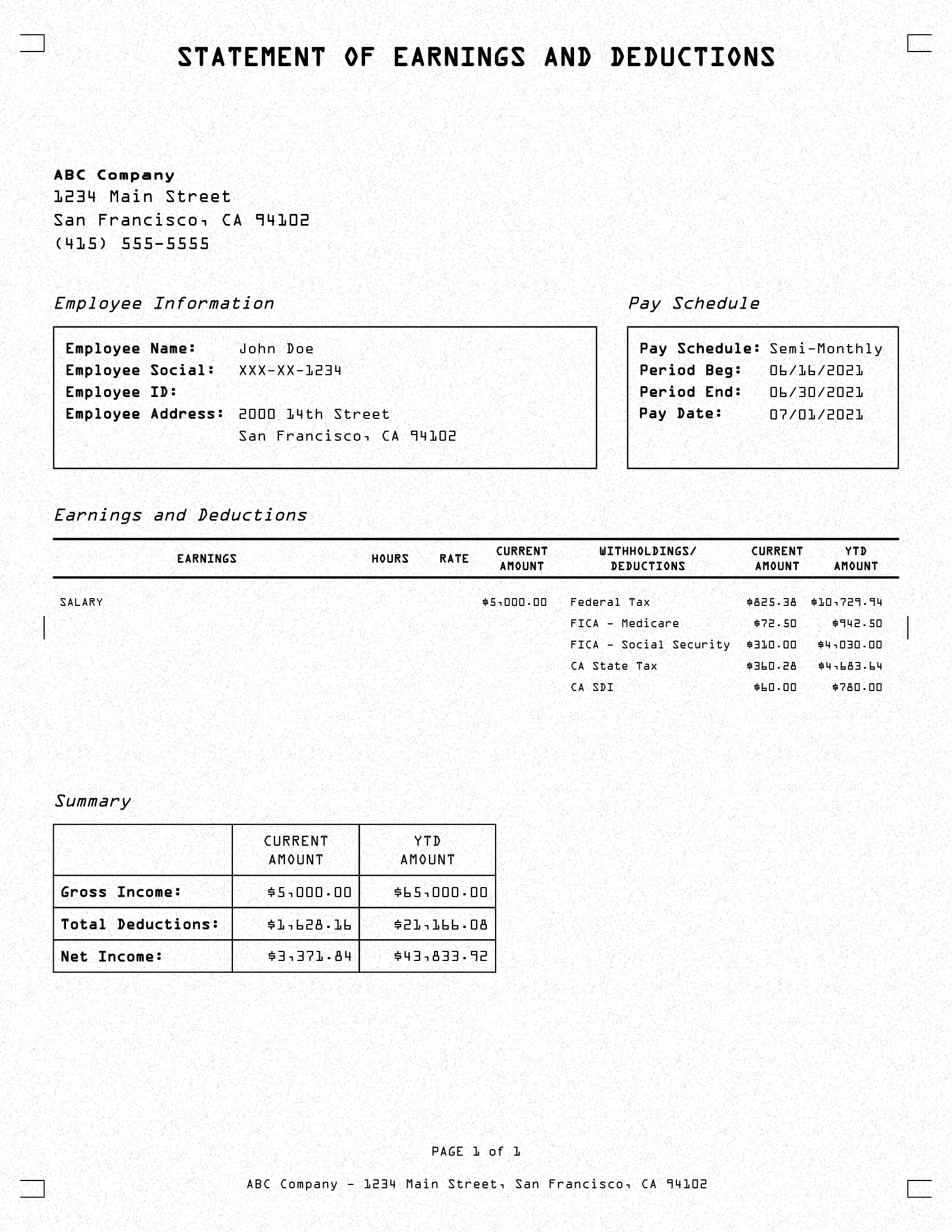

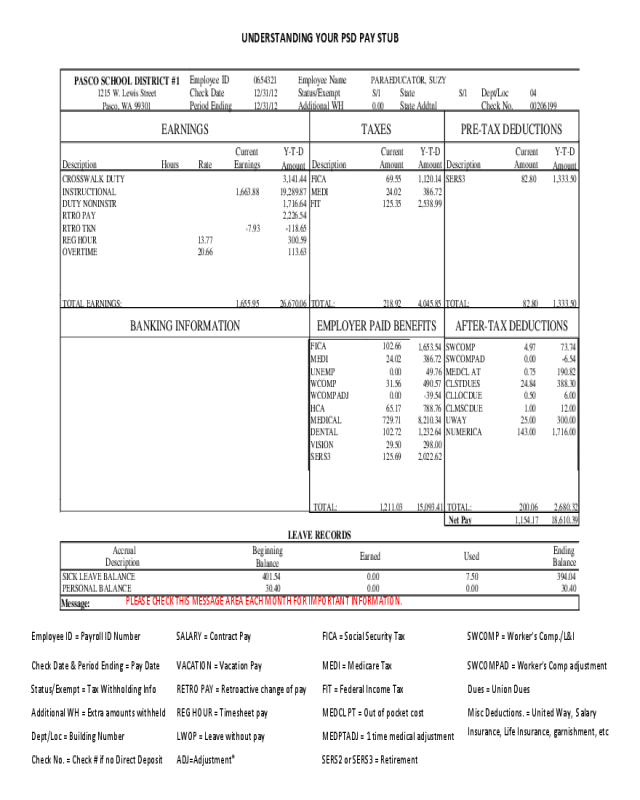

What Are Pay Stub Deduction Codes Form Pros

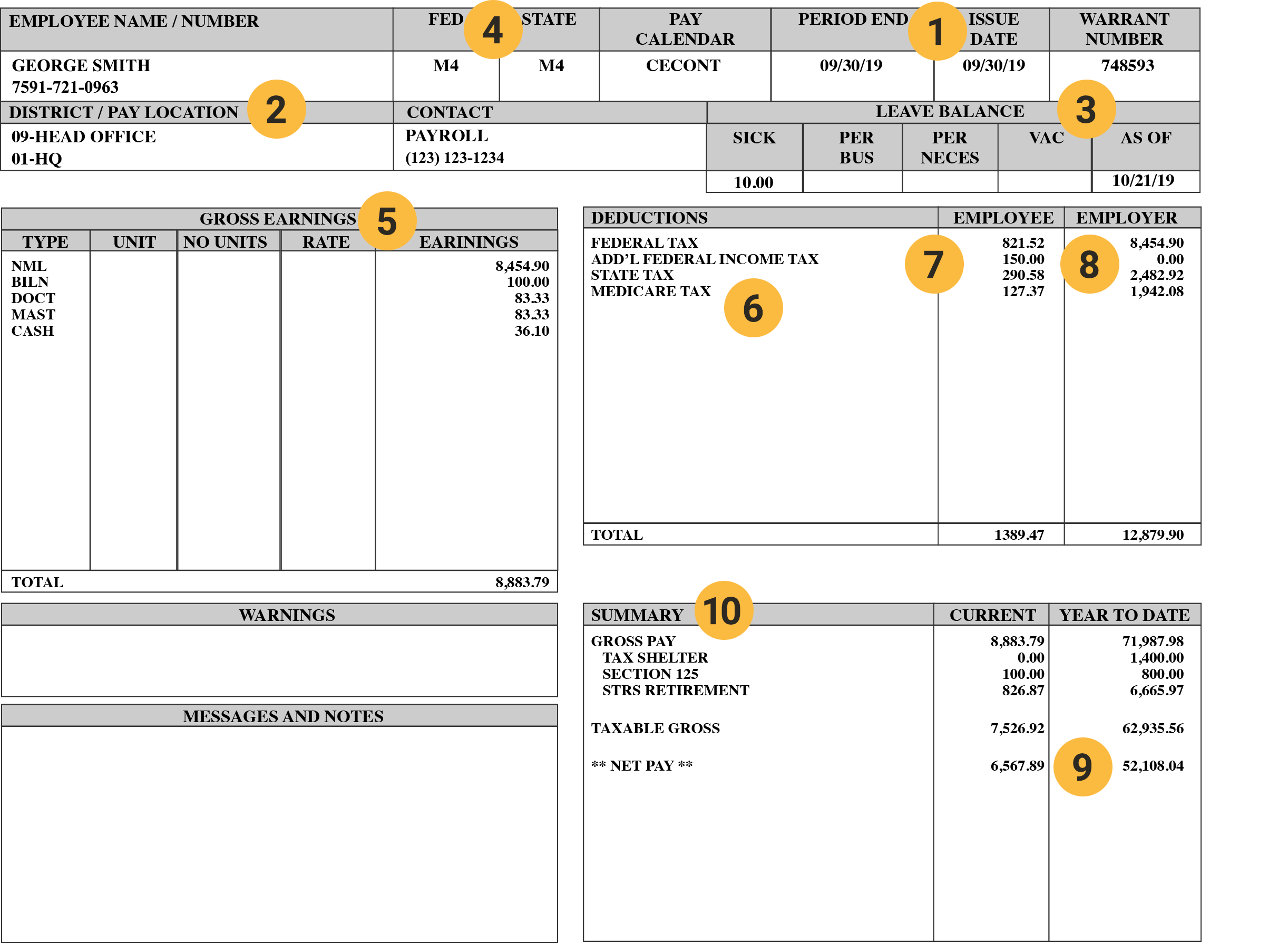

FIT deductions are typically one of the largest deductions on an.

. FIT is the amount required by law for employers to withhold from wages to pay taxes. Fit on paycheck stub Tuesday April 19 2022 Edit. FIT is the amount required by law for employers to withhold from wages to.

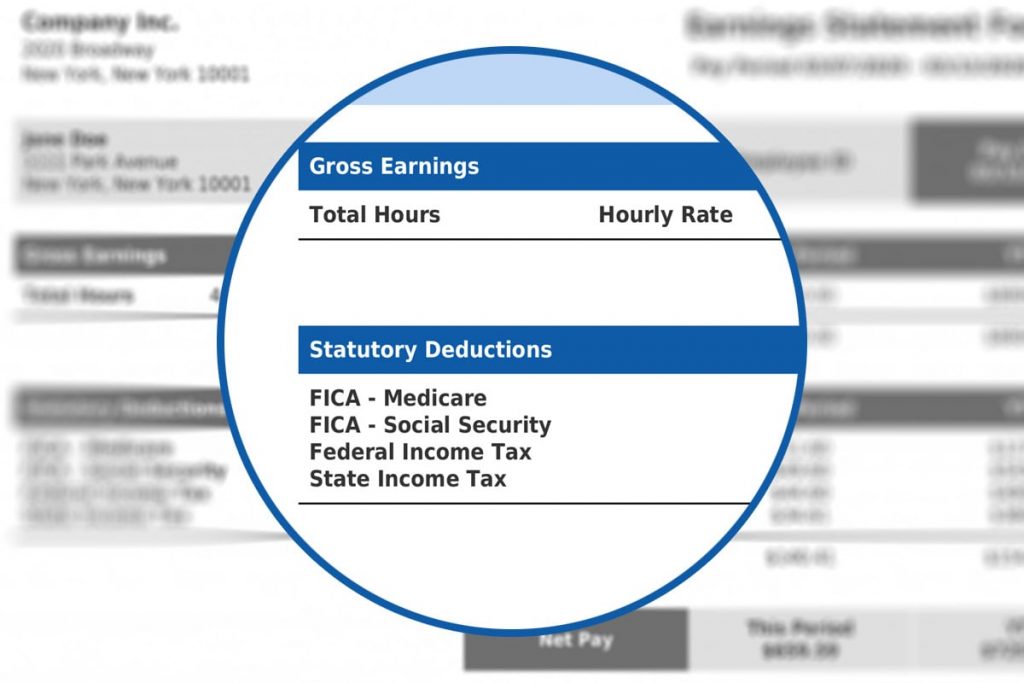

Withholding is one way of paying. Federal Income Tax is withheld from your paycheck based on the amount of income you earn in each pay period. Here are some of the general pay stub abbreviations that you will run into on any pay stub.

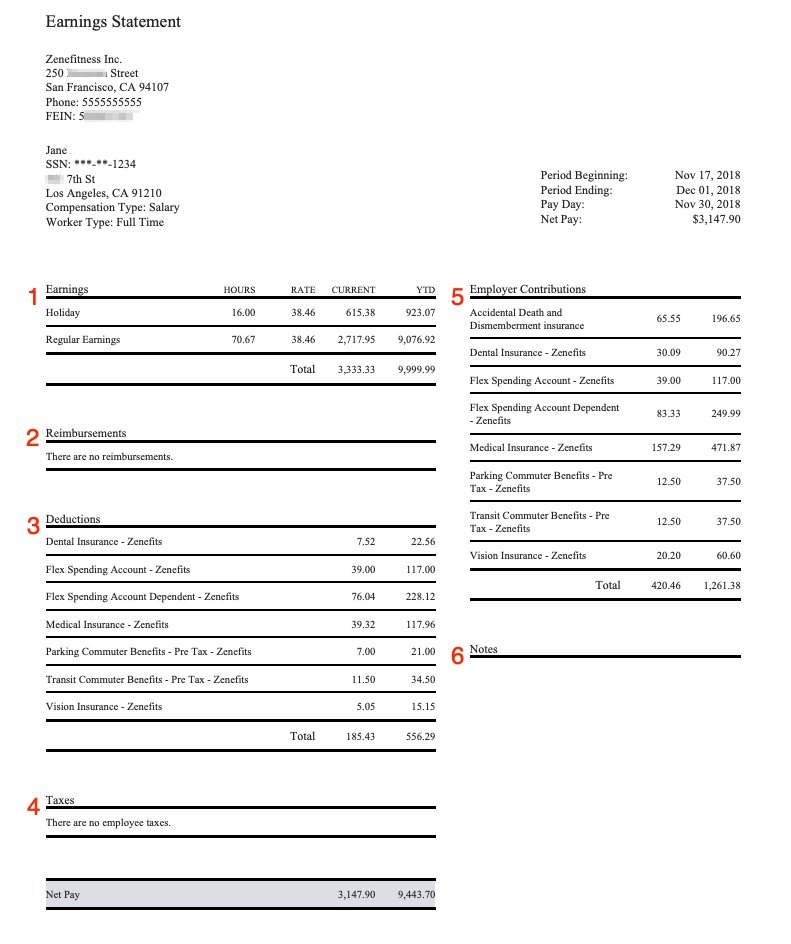

Its worth noting that most deductions come from taxes. A pay stub may be created as a separate part of a paper paycheck or it may exist in electronic form. The FICA deduction on your paycheck funds the Social Security portion of the program.

FIT is applied to taxpayers for all of their taxable income. Fit is applied to taxpayers for all of their taxable income during the year. The amount of FIT withholding will vary from employee to employee.

Fit stands for Federal Income Tax Withheld. Your net income gets calculated. A company specific employee identification number.

It varies by year. The name of the Employee. What does fit stand for on my pay stub.

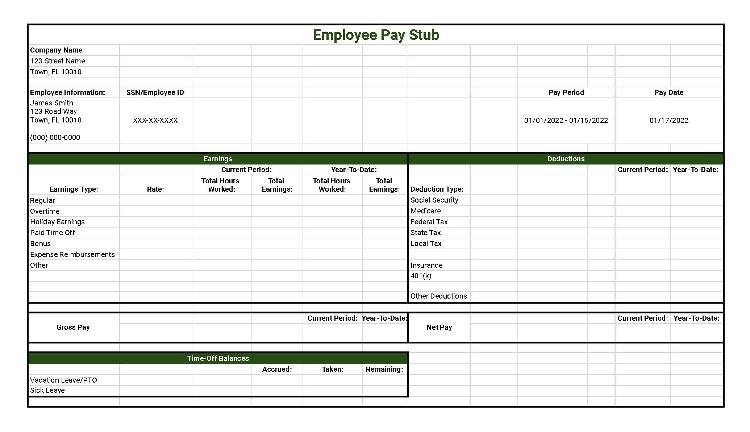

Paystub template for proof of income. FITW is an abbreviation for federal income tax withholding Youll sometimes see it on payroll stubs to identify your withholding deductions. Its important that you understand the FIT Tax implications on your paystub.

TDI probably is some sort of state-level disability insurance. Here are the most common paycheck stub abbreviations that deal with tax deductions. A paycheck also spelled pay check or pay cheque is traditionally a paper document issued by an employer to pay an employee for services rendered.

The Federal Income Tax is progressive so the amount will. One of the largest deductions that you may see on your paycheck is a FIT tax deduction. Pay stubs are also called paycheck stubs wage.

FIT deductions are typically one of the. Federal income tax Federal income. What Does A Pay Stub Look Like.

This amount is based on information provided on the employees W-4. For example a single employee making 500 per weekly paycheck may have 27 in federal income tax. FIT stands for federal income tax.

FICA would be Social Security and Medicare which are not deductions nor credits on your income tax return. FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes. It gets removed from your pay added to the Social Security Tax on Medicare Tax Social Security Tax on Wages.

May 28 2019. Answer 1 of 2. FIT stands for federal income tax.

What is fit deduction. FICA Med This refers.

2022 Pay Stub Template Fillable Printable Pdf Forms Handypdf

Free Pay Stub Templates Tips Laws On What To Include

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

A Guide On How To Read Your Pay Stub Accupay Systems

What Is Fit Tax On Paycheck All You Need To Know

Hrpaych Yeartodate Payroll Services Washington State University

What Your Pay Stub Abbreviations Mean

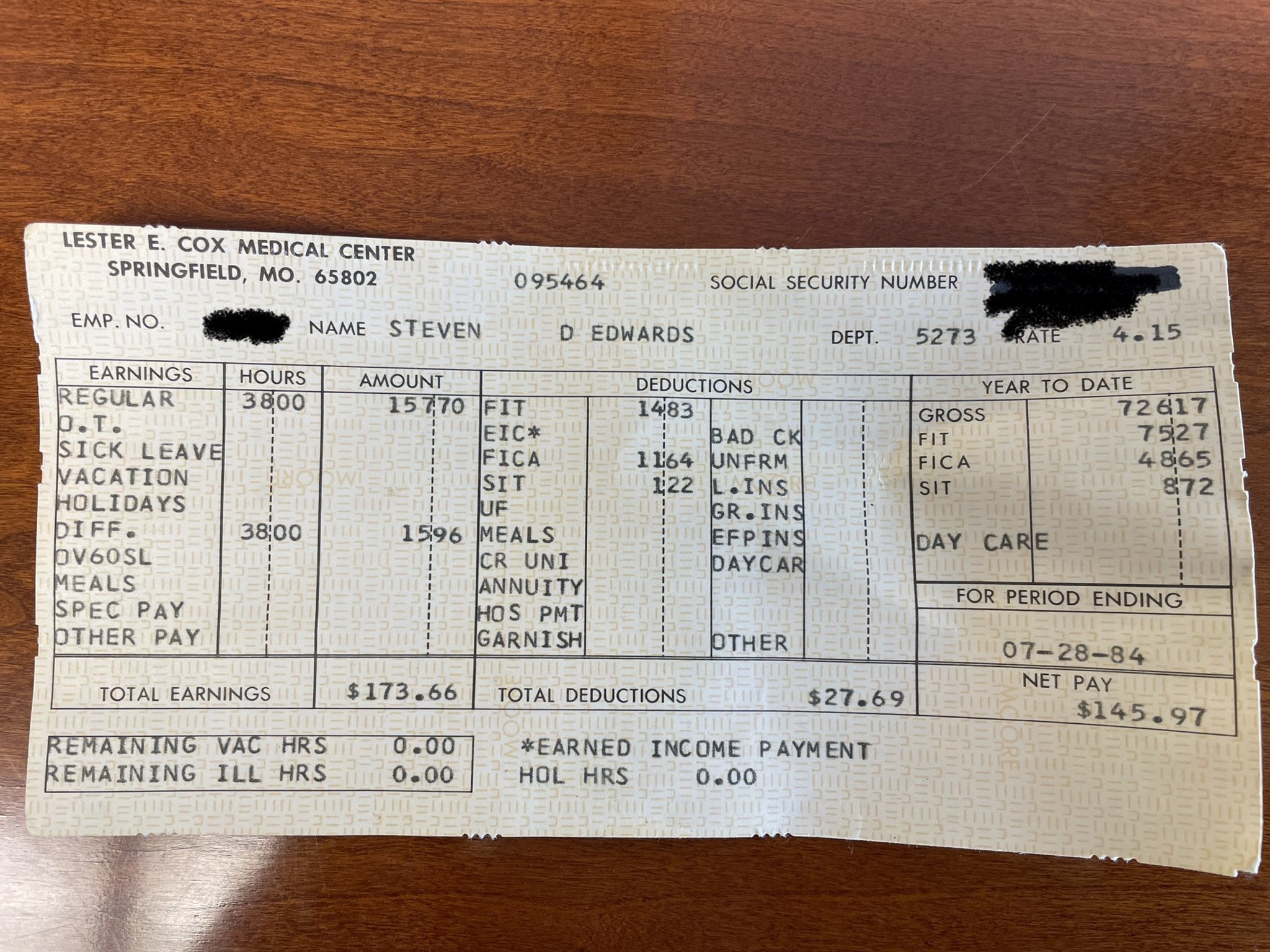

Steve Edwards On Twitter What An Early Pay Check Looked Like As An Er Orderly From 38 Years Ago State Income Tax 1 22 Fica 11 64 Bringing Home The Bacon Https T Co F9tkkrfx2f Twitter

Where Does All Your Money Go Your Paycheck Explained

Understanding Your Paycheck Credit Com

Federal Income Tax Fit Payroll Tax Calculation Youtube

Online Pay Stub Generator 7 Best Options For Your Business

/cdn.vox-cdn.com/uploads/chorus_asset/file/3722016/TyrGObW.0.jpg)

Andrew Mccutchen S Pay Stub Includes Lots And Lots Of Taxes Sbnation Com

Pay Stubs 101 A Complete Guide To Reading Your Pay Stub

123paystubs 123paystubs Twitter